Do Smart Homes Lower Your Homeowners Insurance? sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

Smart homes are revolutionizing the way we live, with technology seamlessly integrated into our daily lives. But did you know that these advancements in home automation could potentially impact your homeowners insurance rates? Let's delve into the intriguing intersection of smart homes and insurance to explore if and how these modern innovations can lead to cost savings and enhanced coverage.

Understanding Smart Homes and Homeowners Insurance

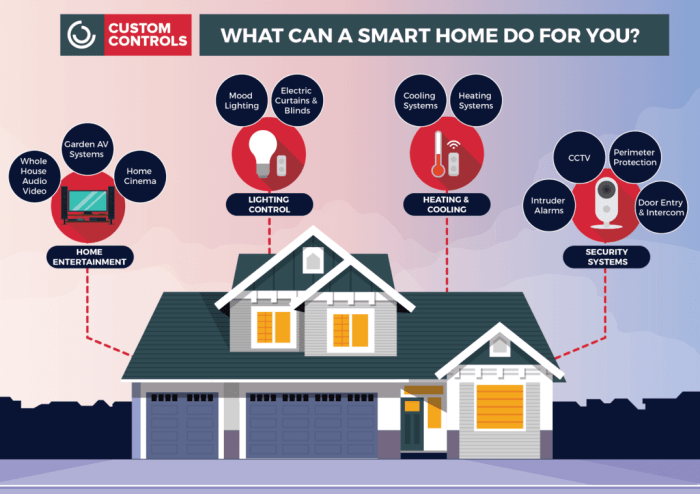

Smart homes refer to residences that are equipped with interconnected devices and systems that can be controlled remotely or automated to perform various tasks. These devices can include smart thermostats, security cameras, lighting systems, and more. These smart features in a home can have an impact on homeowners insurance premiums due to the added security and risk mitigation they provide.

Insurance companies may offer discounts for homes with smart technology that reduces the likelihood of accidents or damages.

Key Features of Smart Homes Affecting Insurance Premiums

- Smart Security Systems: Homes with smart security systems that include cameras, motion sensors, and alarms may qualify for lower insurance premiums due to the reduced risk of break-ins and theft.

- Smart Leak Detection Systems: Devices that can detect leaks and water damage early on can help prevent costly repairs, leading to potential discounts on insurance.

- Smart Fire Alarms: Smoke detectors that are connected to a smart home system can alert homeowners and authorities quickly in case of a fire, potentially lowering insurance costs.

Benefits of Having a Smart Home for Insurance Coverage

- Preventative Measures: Smart homes can help homeowners prevent accidents and damages by providing real-time monitoring and alerts, reducing the likelihood of insurance claims.

- Quicker Response Times: With smart devices that notify homeowners and emergency services promptly, insurance companies may view these homes as lower risk, resulting in potential discounts.

- Enhanced Security: Improved security measures through smart technology can deter intruders and minimize the risk of theft, leading to lower insurance premiums.

Factors That Influence Homeowners Insurance Rates

When it comes to determining homeowners insurance rates, insurance companies take into account various factors that can affect the risk associated with insuring a property. These factors can vary depending on the type of home and the location.

Traditional Homes vs. Smart Homes

Traditional homes and smart homes differ in terms of insurance costs due to the additional safety and security features that smart devices provide. Insurance companies often view smart homes as less risky to insure, leading to potential discounts on premiums.

- Smart security systems: Devices such as smart cameras, doorbell cameras, and motion sensors can help deter theft and vandalism, leading to lower insurance premiums.

- Smart smoke detectors: These devices can alert homeowners and authorities of potential fires, reducing the risk of extensive damage and lowering insurance costs.

- Water leak detectors: Smart devices that detect leaks can help prevent water damage and mold growth, potentially decreasing insurance rates.

Potential Cost Savings with Smart Homes

Smart home technology can lead to significant cost savings on homeowners insurance premiums. Insurance companies often offer discounts for homes equipped with smart features that enhance security, reduce risks, and improve overall safety measures. These discounts can help homeowners save money in the long run while enjoying the benefits of a smart home.

Types of Discounts for Smart Home Features

- Home Security Systems: Insurance companies may offer discounts for homes with monitored security systems that include features such as video surveillance, motion detectors, and smart locks.

- Smart Smoke Alarms: Installing smart smoke alarms that can alert homeowners remotely and automatically contact emergency services in case of a fire may also lead to insurance discounts.

- Leak Detection Systems: Homes equipped with smart leak detection systems that can detect water leaks early and prevent damage may be eligible for insurance discounts.

Real-Life Scenarios of Cost Savings

- A homeowner installed a smart security system with video surveillance and motion sensors. As a result, their insurance provider offered a discount on their premiums due to the increased security measures in place.

- Another homeowner upgraded to smart smoke alarms that could detect smoke and carbon monoxide levels, leading to a discount on their insurance policy for the added safety features.

- One homeowner installed a smart leak detection system that alerted them of a water leak while they were away, preventing extensive damage. The insurance company recognized this proactive measure and provided a discount on their policy.

Risks and Limitations of Smart Home Insurance

Smart home insurance offers many benefits, but there are also potential risks and limitations to consider when relying on smart home features for insurance discounts. It is essential to understand these factors to make informed decisions about your coverage.

Potential Risks Associated with Smart Home Insurance

- Technology Malfunctions: Smart home devices are susceptible to technical issues, such as connectivity problems or software glitches, which could impact their effectiveness in protecting your home.

- Data Privacy Concerns: Smart devices collect data about your habits and routines, raising privacy concerns about how this information is used and protected by insurance companies.

- Cybersecurity Threats: Smart home systems can be vulnerable to cyber-attacks, potentially compromising the security of your home and personal information.

Limitations in Coverage with Smart Home Insurance Policies

- Exclusions for Certain Events: Some insurance policies may not cover specific events related to smart home technology, such as cyber-attacks or data breaches, leaving you vulnerable in these situations.

- Equipment Requirements: Insurance discounts may be contingent on having specific smart home devices installed, which could limit your coverage options if you choose not to use certain technologies.

- Coverage Gaps: Smart home insurance policies may have gaps in coverage for traditional risks that are not mitigated by smart devices, requiring additional coverage to address these vulnerabilities.

Tips to Mitigate Risks with Smart Home Technology

- Regular Maintenance: Keep your smart home devices up to date with the latest software updates and security patches to minimize the risk of malfunctions and vulnerabilities.

- Strong Passwords: Use unique and complex passwords for your smart devices and secure your home network to prevent unauthorized access to your system.

- Review Policy Terms: Understand the coverage limitations and exclusions in your insurance policy related to smart home technology to ensure you have adequate protection for potential risks.

Ultimate Conclusion

In conclusion, the relationship between smart homes and homeowners insurance is a fascinating one, offering both potential cost savings and new considerations for policyholders. By understanding the impact of smart devices on insurance premiums and the risks involved, homeowners can make informed decisions to protect their homes and save money in the process.

Stay informed, stay secure, and embrace the future of smart home technology with confidence.

Question & Answer Hub

Do smart homes really lower homeowners insurance premiums?

Yes, smart homes equipped with advanced security systems and monitoring devices can often qualify for discounts on homeowners insurance.

What are some key features of smart homes that impact insurance premiums?

Features like smart security cameras, smart fire detectors, and water leak sensors can lower insurance premiums due to their risk mitigation capabilities.

Are there any risks associated with relying on smart home features for insurance discounts?

While smart devices can enhance security and safety, there is always a risk of technology failures or vulnerabilities that could impact insurance coverage.